Canopy Growth Aktie : Get the latest Canopy Growth stock price in 2025, explore historical data, and discover expert forecasts predicting significant growth potential for this cannabis sector leader Canopy Growth Corporation (CGC), a major player in the cannabis industry, has experienced significant stock price fluctuations over recent years. As of April 2025, the stock price stands at approximately $1.03, showing a recent intraday high of $1.04 and a low of $0.94. This is a sharp decline compared to its 52-week high of $14.92

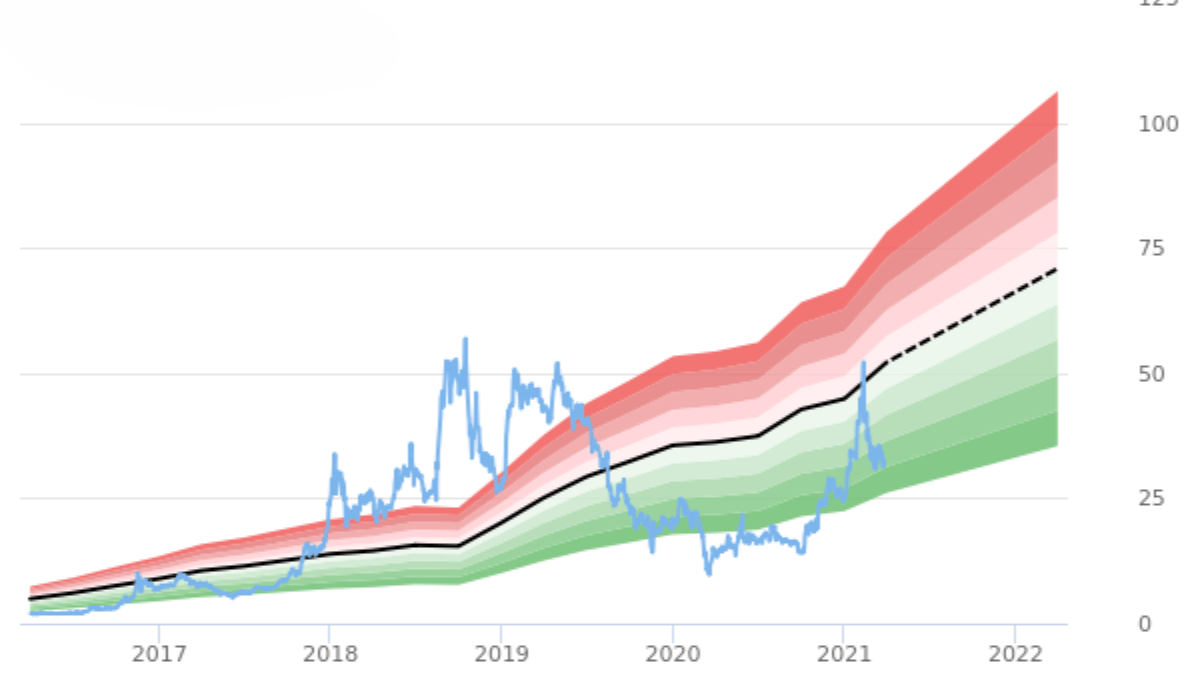

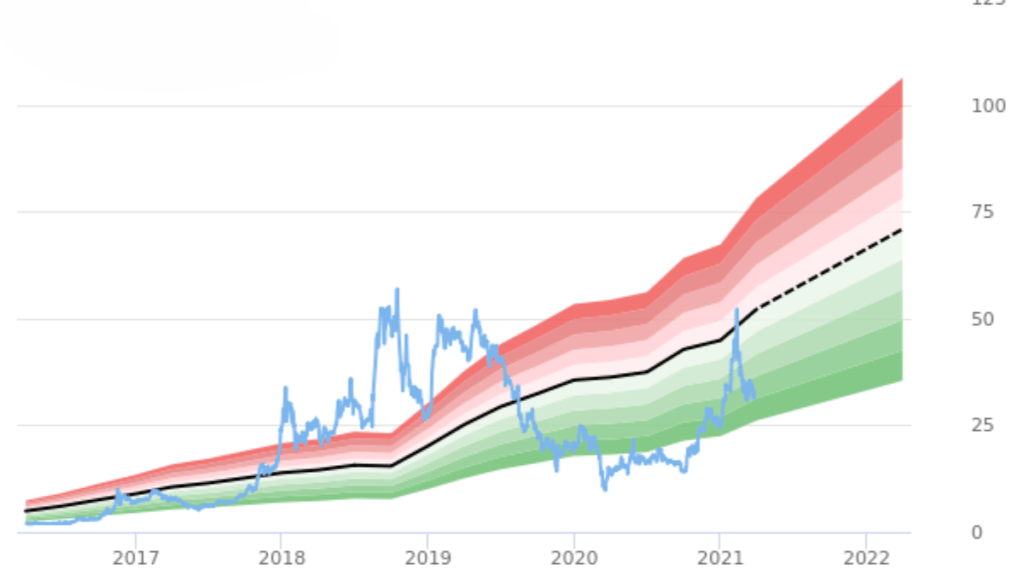

Historical Price Trends

Canopy Growth Aktie

The stock reached an all-time high closing price of $568.90 in October 2018, but since then, it has seen a steep decline.

Over the past year, the price has ranged between $0.77 (52-week low) and $14.92 (52-week high), with an average price around $4.84.

The stock has lost over 85% of its value in the last 12 months, indicating a tough market environment for cannabis stocks.

Financial and Market Overview

Canopy Growth operates primarily in the medical cannabis and recreational cannabis markets, offering products under brands like Tweed.

The company’s market capitalization is around $186 million as of April 2025, a significant drop from previous years.

Earnings per share (EPS) remain negative at -3.59, and the price-to-earnings (P/E) ratio is also negative, reflecting ongoing losses and restructuring efforts.

Forecast and Investment Outlook

Analysts forecast a modest recovery with price targets around $1.28 by the end of the current quarter, suggesting cautious optimism.

The cannabis industry is expected to stabilize as regulatory frameworks improve and market demand grows, but volatility remains high.

Long-term investors should consider Canopy Growth’s potential for growth balanced against its current financial challenges and market risks.

Should You Invest?

Pros:

Leading brand in a growing cannabis market.

Potential upside if legalization and market expansion continue.

Cons:

High volatility and recent steep price declines.

Negative earnings and uncertain profitability timeline.