Ripple (XRP) Price Analysis: Resistance Levels and Bullish Indicators for April 2025

Ripple (XRP) Price Analysis: Resistance Levels and Bullish Indicators for April 2025

Ripple (XRP) Price Analysis : Ripple (XRP) faces mixed market signals but shows upside potential

Derivatives market activity hints at a possible bullish trend ahead April 2025 has brought renewed excitement to the Ripple (XRP) community as the token shows signs of breaking its three-year losing streak. Historically

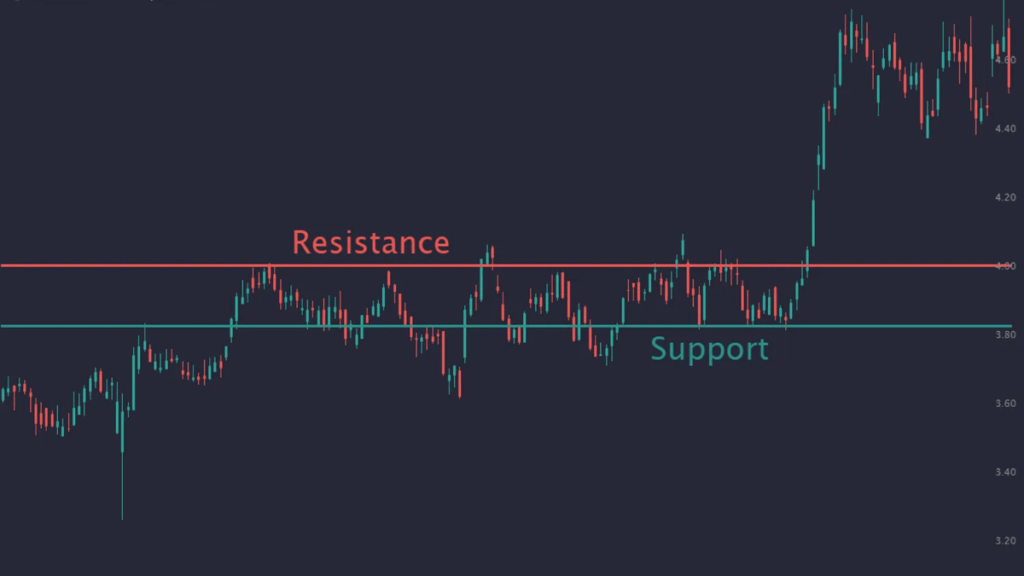

Ripple (XRP) Price Analysis Key Resistance and Support Levels

#Ripple (XRP) Price Analysis

Currently, XRP is trading around $2.15,

having recently surged past the $2.07

resistance with strong volume. The next critical resistance zone to watch is between $2.15 and $2.22; a decisive breakout above this range could open the door for a rally toward $2.40 and even $3.50–$4.50 if momentum continues. On the downside, important support levels are at $2.00 and $1.90, which have consistently attracted buyers during pullbacks.

Bullish Indicators in Play

Technical analysis reveals several bullish patterns for XRP this month. The price is forming higher lows and higher highs, signaling a healthy uptrend. A rare bullish cross on the XRP/BTC chart, reminiscent of the massive 2017 rally, has caught analysts’ attention. The Relative Strength Index (RSI) remains in a bullish zone, and the Ichimoku Cloud shows XRP trading above key moving averages, further supporting the positive outlook. Rising trading volumes and renewed whale activity also point to strong market interest.

Market Sentiment and Outlook

Ripple (XRP) Price Analysis

Investor confidence has been boosted by Ripple’s

recent regulatory clarity and speculation about a potential XRP ETF,

both of which could drive further gains. While short-term corrections are possible, the overall sentiment remains bullish. If XRP can close above the $2.20 resistance, analysts expect a strong move higher, possibly setting new highs before the month ends.

In summary, April 2025 could be a turning point for XRP,

with technical and fundamental factors aligning for a potential breakout. Traders should watch the $2.15–$2.22 resistance closely, as a successful breach could trigger a powerful rally